Content

Consolidation Integrity Manager has embedded controls and alerts to ensure that late adjustments and journal entries are never missed. These items are tracked and aged automatically, offering management full control and visibility into the consolidation reconciliation process, ensuring completeness and significantly reducing risk. BlackLine is a high-growth, SaaS business that is transforming and modernizing the way finance and accounting departments operate. Our cloud software automates critical finance and accounting processes. We empower companies of all sizes across all industries to improve the integrity of their financial reporting, achieve efficiencies and enhance real-time visibility into their operations.

Dramatically decrease time spent validating consolidation data with powerful business rules that map and reconcile data across ledgers and consolidation systems. BlackLine partners with top global Business Process Outsourcers and equips them with solutions to better serve their clients and achieve market-leading automation, efficiencies, and risk control. By outsourcing, businesses can achieve stronger compliance, gain a deeper level of industry knowledge, and grow without unnecessary costs. Whether new to BlackLine or a longtime customer, we curate events to guide you along every step of your modern accounting journey. From onboarding to financial operations excellence, our customer success management team helps you unlock measurable value.

Accrued expenses

A parent company can also allocate its own income and costs to subsidiary companies. By using these techniques, topside entries can be minimized and inconsistencies avoided. Topside entry adjustments are used by parent companies to reflect the business activities what is a topside journal entry of their subsidiary companies. For example, deferred revenues and accrued expenses in the balance sheet of a subsidiary company are recorded as a topside entry. A parent company can then allocate its own income and costs to the subsidiary company.

Depreciation expenditures, often known as non-cash expenses, are the value lost on fixed assets over time. Because the loss is due to wear and tear or obsolescence rather than a monetary outlay, depreciation is a non-cash expense. Laziness, because the accountants don’t want to re-consolidate after getting one additional journal entry to accrue a $1MM bonus for the CFO.

Topside Entry and its Accounting

Only allow one or two people in the department to have system rights to record these types of entries. According to the above context, I think topside means top priority . In the first sentence, it says that the corporate will consolidate all entities both SAP and in Excel format including all the entries which are of top priority and entries which should be eliminated. Corporate will consolidate all entities both SAP and in Excel format including topside and elimination entries. Retail Effectively manage high-volume transactions while providing valuable insight to the business.

What is a topside adjustment?

A topside journal entry is an adjustment made by a parent company on the accounting sheets of its subsidiaries during the preparation of the consolidated financial statements. They are necessary for accounting as they can be used to allocate income or costs from the larger firm to the subsidiaries.

Streamline and automate detail-heavy reconciliations, such as bank reconciliations, credit card matching, intercompany reconciliations, and invoice-to-PO matching all in one centralized workspace. Drive visibility, accountability, and control across every accounting checklist. This will allow the user to drill down on the Dimensions in order to get more information about the Intercompany data. This icon performs No Calculate and all the standard Calculate, Translate, and Consolidate options.

View entire issue

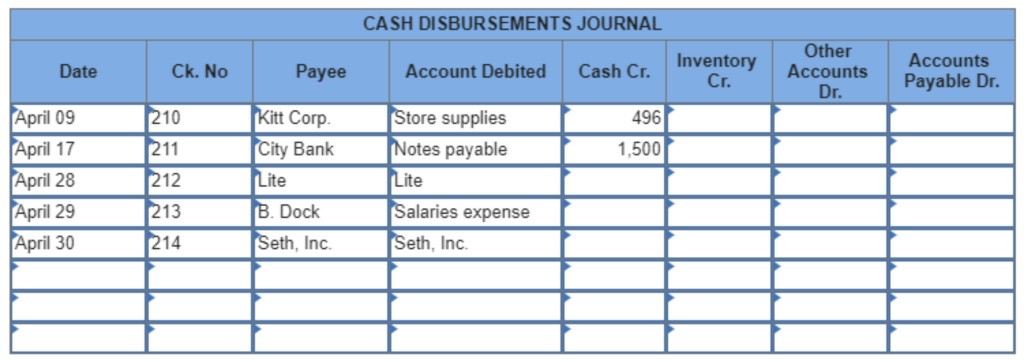

During the first month of its operation the company had the following transactions. In the case of payroll expenses, the wages expense, these accounts are debited, and the cash account is credited. No matter the amount, make sure that all top-side and post-close journals are approved by senior management before posting—like the VP of Finance or CFO. As these are no ordinary entries, they need no ordinary approval.

What are the three types of journal entries?

- Opening entries. These entries carry over the ending balance from the previous accounting period as the beginning balance for the current accounting period.

- Transfer entries.

- Closing entries.

- Adjusting entries.

- Compound entries.

- Reversing entries.

Audit and Compliance Implement your financial governance model throughout the entire month-end close. The nature of the adjustment would guide whether it is most convenient to reverse. Subsidiary equity pickup maybe less so, but a balance sheet reclassification probably more so. Decreasing the expenses or liability and increasing the profits or assets value.

Audit and Compliance

Consolidated financial statements compute the financial position and the results of operations of two or more subsidiaries , as if they were one company. The unrealized profits or losses in these intercompany transactions must be eliminated until intercompany profits or losses are realized through the sale of the assets to outsiders. Topside journal entries are non-routine manual accounting entries. They can be valid accounting methods because they allocate parent company expenses and income to subsidiaries. These methods are particularly susceptible to fraud, especially among companies undergoing mergers. A topside journal entry affects only the general ledger account balances, not any underlying transactions that created those balances.

- F&A teams have embraced their expanding roles, but unprecedented demand for their time coupled with traditional manual processes make it difficult for F&A to execute effectively.

- Typically if you’re being audited for completeness, you would provide the trial balance from the GL, and also a list of all topside entries, combining these two sources should tie to your financials.

- The business enterprise benefits, in many ways, by bypassing journal entries.

- A parent company can then allocate its own income and costs to the subsidiary company.

- It is also important that the list is system generated and not manually compiled.

- Together with expanding roles, new expectations from stakeholders, and evolving regulatory requirements, these demands can place unsustainable strain on finance and accounting functions.